Mechanical or Discretionary Binary Options Trades

Pros and Cons of Discretionary and Mechanical Trading

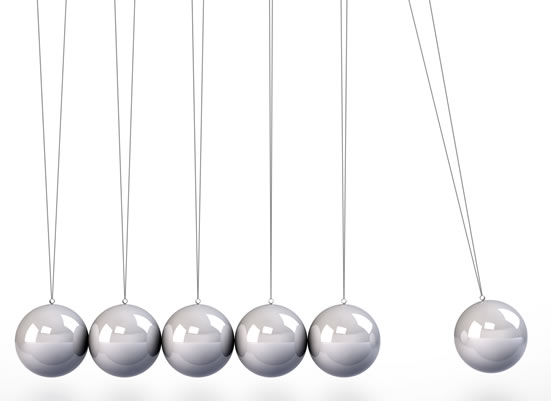

Are you familiar with the concepts of mechanical and discretionary trading? These two terms are contrasted with one another, and describe two different approaches to trading binary options (they also apply to stock trading, Forex, or any other form of trading that exists). They actually exist as endpoints on a scale, however, and most traders fall somewhere in the middle of the spectrum. Let me rephrase that. Most traders who are successful fall somewhere in the middle. There are actually a lot of traders at either end, but by placing yourself at either end, you expose yourself to hazards which are avoidable if you take a more balanced approach.

What are discretionary and mechanical trading as approaches? Here are the definitions of the endpoints of the spectrum:

Mechanical trading: This is a method for trading where all trade decisions are made according to an exact set of rules (a trading system). Traders do exactly what their system tells them to do, without deviating in any way based on instinct.

Discretionary trading: This is a method of trading where all decisions are made according to the instincts of the trader. No system is used.

Does either of these methods sound like they describe what you do when you trade? Many newbie traders are full-on discretionary traders. They approach binary options thinking, “I know a few things about economics; I can probably profit,” and they try their luck. Really, full-on discretionary trading based on instinct with no systematic approach can just be re-phrased as “gambling.” Because that is what it is.

There are a lot of people who are full-on mechanical traders, too. At first this may seem like a better approach, and it is—but it also has its drawbacks, and they can eventually lead to trading losses and a feeling of helplessness, because mechanical trading does not encourage the participation of the trader.

Let’s break it down and examine each type of trading, and then see how we can combine aspects of each approach for trading success.

Mechanical Trading

Pros:

- Decisions are not made randomly. They have a solid basis underlying them, one which is tested and proven. That means you are not relying on your own imperfect knowledge or interpretation to succeed.

- Increased consistency and reliability results from using a trading system. Not only do your decisions have a basis, but they do not deviate randomly from that basis. You can rely on your performance because you repeat what you do. You do not suddenly stop what is working and start doing something else.

- You get away from a gambling mindset. When you rely on a system to tell you when to trade and when not to trade, you learn a mindset of responsibility, honesty, and patience. You get away from the mindset where you think you can make money overnight or where you are seeking a passing thrill.

Cons:

- The short-term risk with mechanical trading is that you may take losses that you do not need to, because you are letting your system make all your decisions. Oftentimes traders do gradually develop an instinct for trading that helps them to be profitable. Or you might notice something about the context of a trade which tells you that you should not be taking it, even if your system says that you should. Whether you skip that trade to save money or you alter your system to avoid those trades, that involves discretion.

- The long-term risk is that you will not alter your system when it needs improvement. You may become detached from your trading to the point where you do not notice something going wrong, or if you do, you do not know how to fix it because you have no understanding of your own trading beyond the basics.

Discretionary Trading

Pros:

- You are actively engaged in your trading. This may be about the only pro to full-on discretionary trading that I can think of. You are bound to get a feel for what is going on over time because of your constant exposure to the market and the level of awareness you are cultivating. But without training that instinct, you will never become so intuitive you can profit consistently and reliably.

Cons:

- You are bringing chaos, not order, to a situation where you need order on your side. Why is trading an activity of risk? Because there are so many factors impacting trading that the market is partially unpredictable. There is no such thing as a perfect system which predicts all, but with no system at all, you are introducing your own random responses to a situation where randomness is already costing you money. But if you bring a system, you bring order, and that helps you to avoid the pitfalls of chaos already present in the market.

- The decisions you make will be unreliable. Your intuition is not a concrete thing, and the choices you make will always be changing. If your instincts work for a while, and then stop working, you have nothing to go off of when you try to figure out why things were working and then they stopped.

- A gambling mindset sets in. Being as your choices are already random, you are bound to start making decisions that are going to cost you lots of money. You literally have nothing stopping you from wagering on bad trade after bad trade, because your basis for trading in the first place makes no sense.

- You are not as smart as you think you are. If you actually believe that your intuition alone is enough to make you profitable, you are already greatly overestimating your own abilities. You are a trader, not a god. If you start behaving as though you are one, you will not last long in binary options trading.

Combining the Best of Both Worlds

What are the good things we can take from each approach to trading?

Mechanical Trading: The best thing that mechanical trading can contribute to our success is a disciplined, systematic approach with a real basis for making trades.

Discretionary Trading: Staying involved in your trading and being willing and adaptable enough to make changes when necessary is a great aspect of discretionary trading.

What is great about these two approaches it that when you combine them, the good aspects of each can cancel out the bad aspects, resulting in a sound approach to trading for the short term and the long run. Find or create a great trading system which you can use to reliably spot and execute good trades and avoid bad ones, but keep your head in the game. When you see a trade you know isn’t good, despite your setup satisfying your system criteria, consider skipping it. And if you start seeing patterns of these imperfections, try testing modifications to your system and see if you can create improvements.

In this way you mitigate chaos, but you also stay flexible enough to survive changes in the market. You may still find yourself more on one side of the scale than the other, but as long as you find a balanced approach that works, you are far more likely to excel than if you simply stick to trading that is 100% mechanical or discretionary.

Read these articles to learn about the tripod of success as well as using your own characteristic skills to be successful.